Quadra® is a SaaS solution used for maintaining insurance exposure asset information, allocating costs, and managing risk through a streamlined, easy-to-use interface. Advanced capabilities drive the end-to-end billing process, resulting in more efficient financial operations.

Commercial property and casualty insurance brokers, nonprofits, risk retention groups, insurance pools, captive insurers, trusts, and REITs all benefit from Quadra's array of features.

Overview

OverviewCentralize & simplify

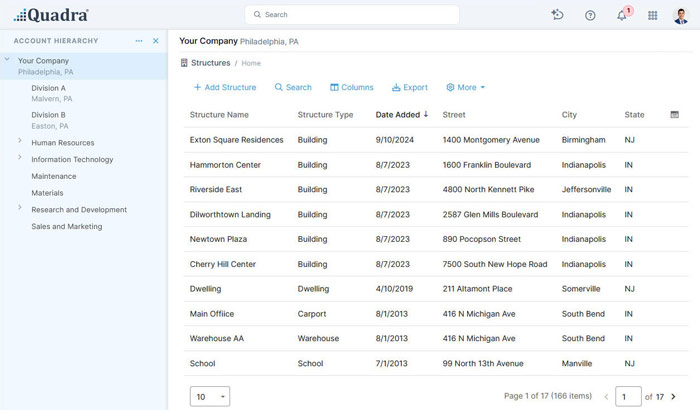

Manage insurance exposures

Quadra accommodates data for all types of exposures including real estate, fleets of vehicles, machinery, payroll, pensions, and more. Learn more

Allocate with ease

Allocating costs is a complex process, but Quadra makes it simple. The Allocations module calculates the true cost of risk across your assets, resulting in fair charges for all accounts. Learn more

Maintain insurance documents

Consolidate insurance policy information, issue and maintain ACORD insurance certificates, and generate vehicle insurance ID cards. Learn more

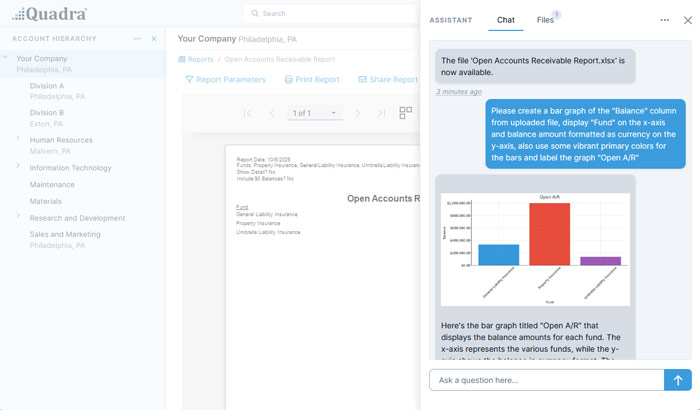

Access valuable insights

Quadra’s AI assistant supports team members in finance, operations, risk management, and human resources. Learn more

Customize for your organization

Author and modify reports, define relevant dashboard elements for yourself and your organization, and create user-defined fields to capture data relevant to your organization Learn more

Manage risk

Improve company-wide loss control efforts on multiple fronts through a singular set of modules. Learn more

Powering our features

Quadra’s modules readily support the complex operations of insurance program management. Together, they make the wide array of features possible.

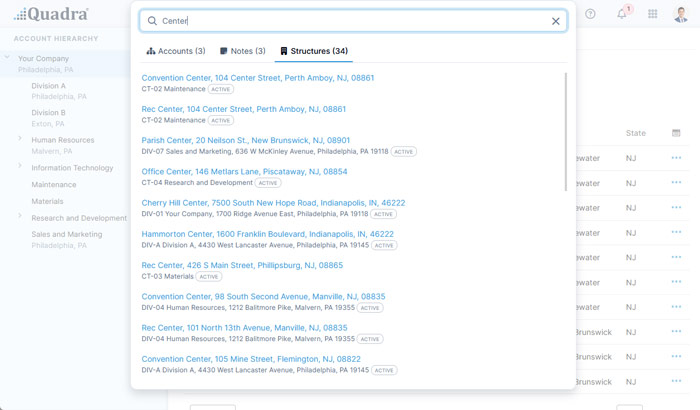

Open & intuitive

Quadra's interface is open and intuitive, allowing for efficient navigation and task execution.

Customer success stories

“The Quadra system has significantly increased our organization's ability to not only manage our data for the Department of Risk Management, but has also allowed us to become more integrated with other departments...”

Thomas Alban

Director of Risk Management

"Quadra helps us make better decisions with our insurance allocation. It allows us to test ideas and review the output before finalizing the allocation. ...Quadra has allowed for more accurate billing...”

Laurie Downey

Controller

Show me more!

We'd love to discuss how Quadra can solve your insurance business needs.